February 20, 2026 • min read

Healthcare revenue cycle management explained for payers

Learn how revenue cycle mechanics drive MSK spend, and why outcome-linked models give payers clearer forecasting, lower volatility, and stronger ROI.

Written by

Evidence-based healthcare insights

Sword Summary Warm-up

Don’t have time for the full workout? We’ve got you covered with a quick, high-intensity session. Here are the key takeaways:

- The healthcare revenue cycle is where clinical decisions become claims, denials, billing delays, and ultimately spend. Its complexity affects how reliably payers can forecast and control MSK costs.

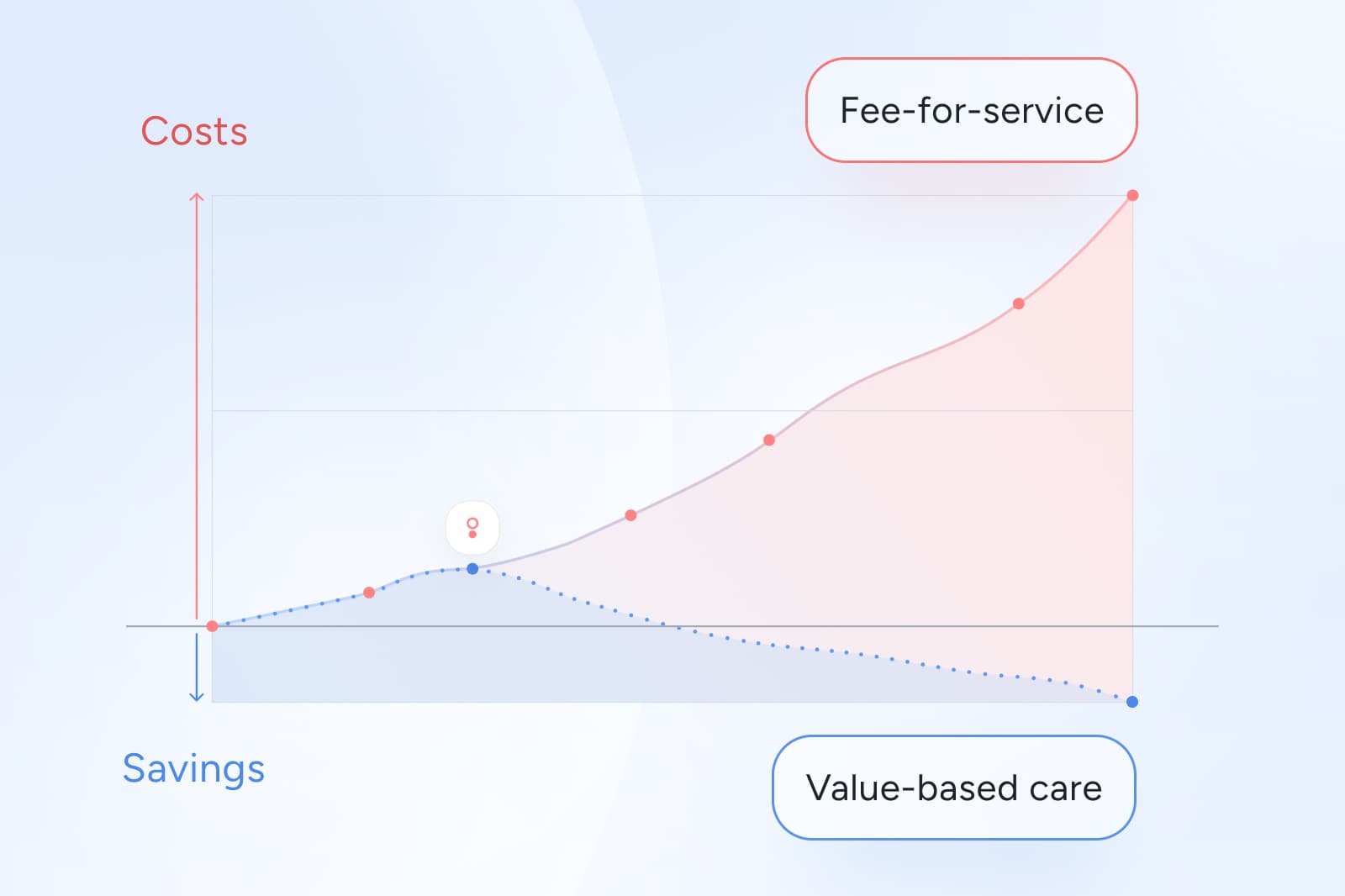

- Fee-for-service accelerates administrative noise because it rewards volume, not recovery. That structure creates more transactions, more variation, and less visibility into whether care improved members’ health.

- Value-based care providers give health plans a clearer, more predictable revenue flow by tying payment to improvement, not activity.

How the healthcare revenue cycle can impact ROI for payers

Most health plan leaders never touch claim-level RCM files directly. But the ripple effects are everywhere: rising MSK budgets, escalating prior auth pressure, inconsistent forecasting, and unexplained cost spikes that CFOs expect you to explain.

The revenue cycle shapes all of this, determining:

- how many claims arrive,

- how often they are denied or reworked,

- when large-dollar procedures hit your budget, and

- how easy (or impossible) it is to connect spend to actual member improvement.

Under fee-for-service, each additional service adds a new data point, a new claim, and a new opportunity for variation. That inflates MSK spend while obscuring what actually helped members recover.

There is a strong alternative to consider, as newer outcome-linked MSK models by matching payments to measurable healthcare results. This allow payers to treat the revenue cycle as a strategic tool instead of a downstream administrative burden with more accurate forecasting.

What is healthcare revenue cycle management?

Healthcare revenue cycle management (RCM) is the end-to-end process that turns care into payment. Every MSK claim a plan receives has moved through these steps:

- Eligibility verification (confirming the member’s benefits)

- Documentation (providers record diagnoses and procedures)

- Coding (clinical notes become billable CPT and ICD-10 codes)

- Claim submission

- Adjudication (payers approve, deny, or pend claims)

- Member billing (any remaining balance)

- Denials, appeals, and audits

- Financial reporting and reconciliation

Each step generates administrative workload. The fee-for-service model ensures those steps repeat over and over again during the same MSK episode.

In MSK care, where members often see multiple providers, undergo imaging, escalate to specialists, and sometimes proceed to surgery, the revenue cycle multiplies complexity.

Typical timing benchmarks for the healthcare revenue cycle

While every provider system operates differently, national benchmarks show common patterns:

- 0–3 days from visit to documentation⁷

- 3–14 days for coding and claim submission⁸

- 7–30 days for adjudication⁹

- 30–120+ days for appeals and collections¹⁰

These timelines stretch when documentation is incomplete, coding errors occur, or multiple providers touch the same MSK episode, which are all frequent realities in fee-for-service MSK healthcare.

For payers, these timing variations create unpredictable spend patterns, inconsistent accruals, and difficulty forecasting quarterly MSK exposure.

Why the traditional RCM model breaks down for payers

The revenue cycle was designed to ensure providers get paid. Unfortunately for those managing health plans for employers and insurers, this revenue cycle is not designed with healthcare value or member outcomes in mind. This creates predictable blind spots for payers:

- Healthcare providers are often focused on tracking transactions, not outcomes.

- The system rewards billing efficiency, not clinical efficiency.

- The result of this obscures which services improved function or prevented surgery.

The consequence is contributing to a wider trend of increasing healthcare costs across the broader industry. MSK costs appear random as analysis is so difficult. Healthcare providers and payers alike find it hard to isolate the causes of increasing spend.

But payers can regain control when they analyze the cycle through a value-based lens instead of a billing lens.

Fee-for-service makes the revenue cycle harder to manage

To see why the revenue cycle amplifies MSK spend, consider a typical FFS cascade:

A member develops low back pain. Under a fee-for-service healthcare model, some variation of the following process is likely:

- A primary care visit generates a claim.

- Early MRI is ordered (often before conservative care) which increases cost and the likelihood of downstream procedures⁹.

- Imaging triggers specialist referrals.

- Injections or other medicines are often prescribed.

- Surgery is recommended if symptoms persist.

- Postoperative rehab generates more claims.

A substantial share of imaging and surgical procedures for MSK conditions do not improve long-term outcomes³. Early imaging also increases unnecessary surgical utilization⁹. Conservative care applied early often reduces downstream cost and escalation⁵. Many members undergo avoidable procedures that offer limited benefit⁶.

This fee-for-service pathway creates high and variable claim volumes, late-arriving surgical claims, fragmented utilization signals, and weak visibility into functional improvement.

How value-based care simplifies the revenue cycle for payers

Value-based care fundamentally restructures how money moves through the system. Instead of billing for every visit, VBC contracts seek to:

- tie payments to clinical improvement,

- reward early, conservative, guideline-aligned care,

- reduce low-value imaging and surgeries, and

- strengthen forecasting predictability.

Over 40% of healthcare payments now include some form of value-based contract, where payment is tied to quality or outcomes, not just services delivered⁴. MSK is one of the strongest use cases due to high variation⁸ and high prevalence of unnecessary procedures³.

Outcome-based pricing transforms revenue cycle predictability

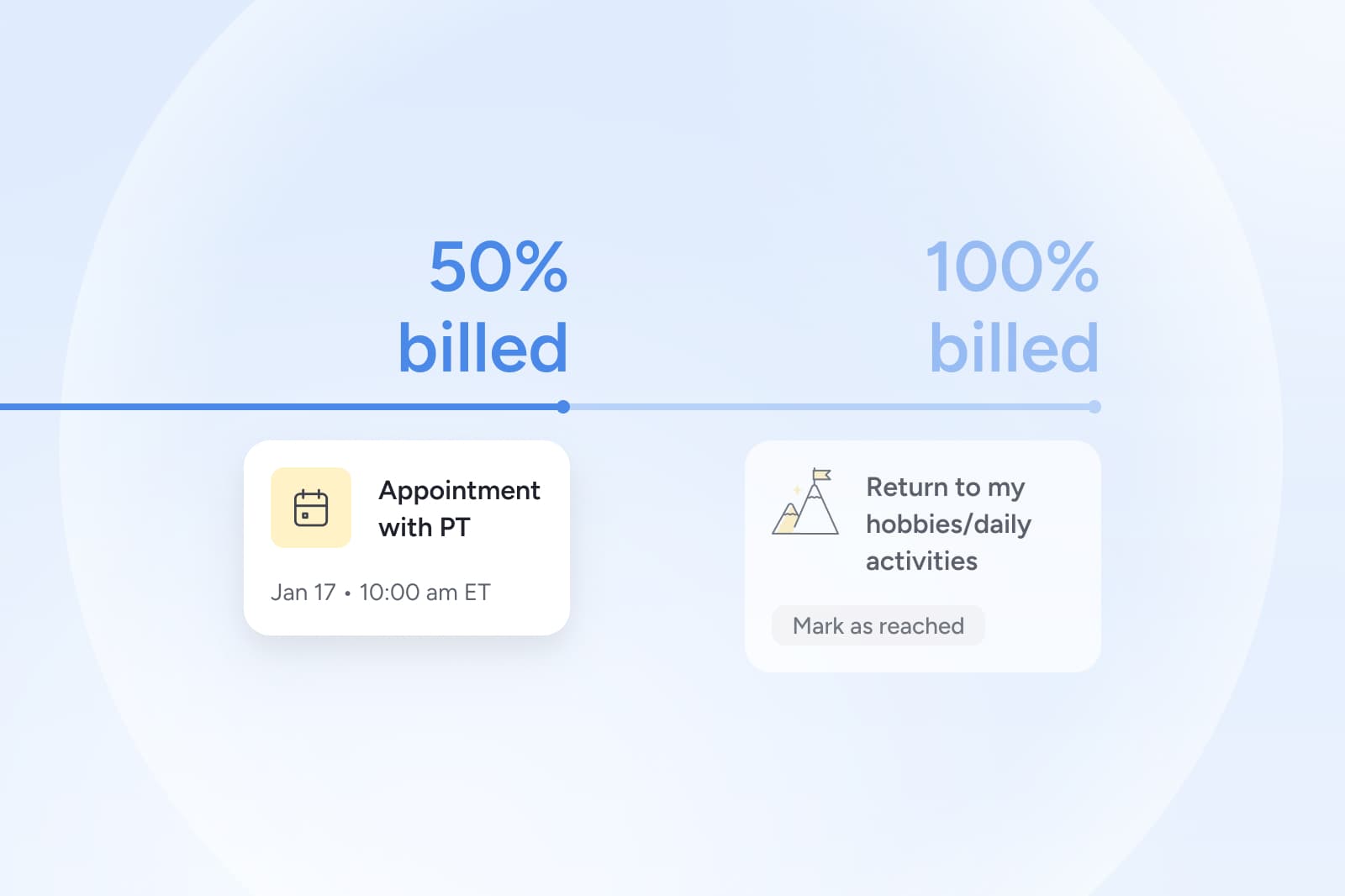

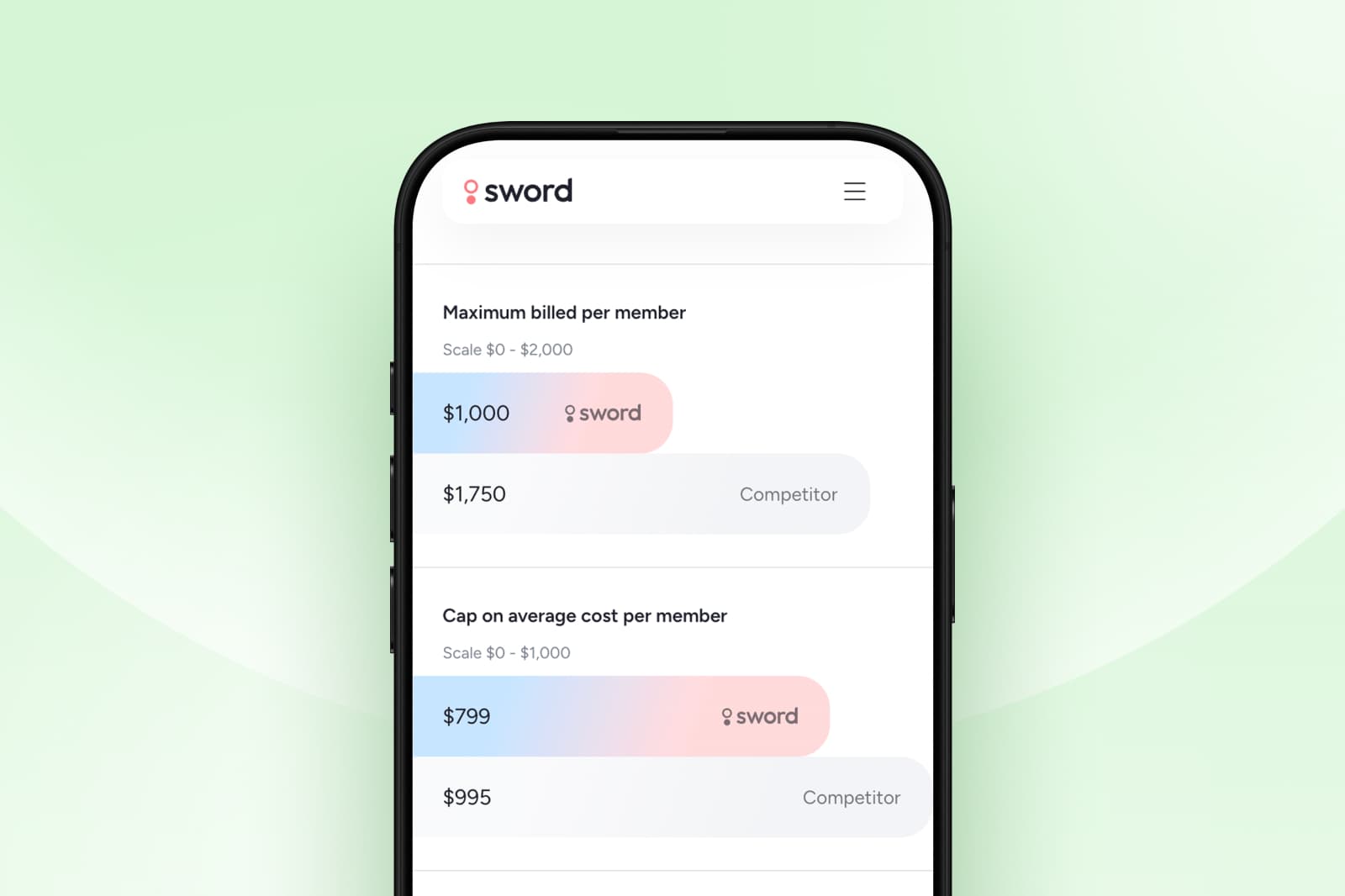

Outcome-based pricing links revenue to verified improvement, not claim volume. Sword Health pioneered this style of engagement-based pricing, setting the industry standard so clients only pay when members actively participate in our programs.

What is Outcome Pricing?

Outcome Pricing is a bold approach to healthcare pricing that Sword Health aligns our financial incentives with the success of our members and clients. Unlike other models, where clients pay the full price even if their members see little or no improvement, Outcome Pricing is rooted in a simple, yet powerful concept: We only succeed when our clients and members do, too.

By structuring fees in this way, we ensure that our clients only pay the full cost when members experience real, measurable benefits.

GUARANTEED SAVINGS

Get the industry's highest ROI and slash MSK spend with Sword

3.2x

Average ROI (the industry's highest independently-validated rate)

70%

reduction in surgery intent

41%

fewer ancillary services

10%

drop in MSK-related MRIs

35%

reduction in spine surgeries

For Sword clients, Outcome Pricing is a partnership rooted in shared goals and aligned incentives. By tying fees directly to results, we give clients greater confidence that their investment in Sword is based on real, transformative change for their members.

How outcome-linked MSK models improve day-to-day payer operations

Results become much easier to track and quantify. The impact is clear for Sword clients.

- Fewer surprise bills and disputes: No per-visit billing reduces member confusion and HR burden.

- Clearer forecasting and budgeting: Activation + outcome payments model more cleanly than hundreds of fragmented claims.

- Stronger alignment between care delivery and cost: When payment requires improvement, providers focus on early intervention and preventing avoidable surgeries.

- Better data for strategy and reporting: Outcome-linked models use validated measures, giving leaders clean signals for executive reporting, budgeting, and vendor evaluation.

Independent actuarial analysis of Sword’s AI Care programs shows substantial per-member annual savings and a 3.2x ROI⁵. Set up a chat with a Sword expert to see what outcome pricing would look like for your population, plan design, and procurement requirements.¹⁰

Start saving $3,177 per member per year

Slash MSK costs and get the industry’s top validated ROI of 3.2:1.

Footnotes

Tseng P, Kaplan RS. Administrative Costs in the US Health Care System. Health Affairs Forefront. 2020. https://www.healthaffairs.org/content/forefront/administrative-costs-us-health-care-system-forgotten-billions

Cutler DM, Ly DP. The (Paper) Work of Medicine. Journal of Economic Perspectives. 2011. https://www.aeaweb.org/articles?id=10.1257/jep.25.2.3

Mafi JN, McCarthy EP, Davis RB, Landon BE. Worsening Trends in the Management and Treatment of Back Pain. JAMA Internal Medicine. 2013. https://jamanetwork.com/journals/jamainternalmedicine/fullarticle/1694233

Health Care Payment Learning & Action Network. https://hcp-lan.org/apm-measurement/

Risk Strategies Consulting ROI Analysis of Sword Health's AI Care programs: https://swordhealth.com/reports-and-guides/total-cost-of-care-analysis

Deyo RA et al. Overtreating Chronic Back Pain. JABFM. 2009. https://www.jabfm.org/content/22/1/62

Healthcare Financial Management Association (HFMA). https://www.hfma.org

Dartmouth Atlas of Health Care. https://www.dartmouthatlas.org

Webster BS, Cifuentes M. Early MRI and unnecessary surgery. https://pubmed.ncbi.nlm.nih.gov/20479169/

American Medical Association. Claim Denials and Appeals. https://www.ama-assn.org