October 24, 2025 • min read

How MSK insurance models help employers save costs

Explore the common MSK insurance models and learn how employers can cut costs and boost healthcare ROI with digital-first care.

Written by

Evidence-based healthcare insights

Musculoskeletal (MSK) conditions are a top cost driver in employer health plans, yet most coverage conversations stop at “does the plan cover physical therapy?” While that’s important, it only scratches the surface. Employers have more strategic levers available with a number of different MSK insurance models available for consideration. These structures can determine whether you’re paying for waste or investing in real healthcare outcomes.

This article explores how different MSK insurance models work, what they mean for employer costs, and how value-based options can unlock ROI without cutting care. You’ll get seven proven strategies that employers can use to reduce healthcare costs without cutting benefits. From smarter plan design to digital-first care models like Sword Health, we’ll explore how to lower spend, improve outcomes, and deliver more value to your workforce.

Why MSK insurance design matters

Healthcare costs are climbing, and employers are feeling the strain. U.S. health insurance premiums for employer-sponsored plans jumped 7% in 2024, reaching more than $24,000 for a family plan¹.

Behind these numbers are some familiar cost drivers:

- Chronic disease

- Specialty drugs

- Rising utilization

- Inefficient care delivery

- Hidden but preventable MSK claims

While the trend may seem inevitable, the right strategies can help employers reverse it. MSK disorders account for more than $505 billion in U.S. spend each year, with nearly $91 billion wasted on low-value interventions like unnecessary surgery and imaging². For employers, MSK consistently ranks as the number one or two claims category, often above oncology and cardiovascular disease.

When plan design treats MSK like any other commodity benefit, costs balloon. High deductibles or visit caps delay care, pushing members toward imaging, opioids, or surgery. That drives higher claims, longer absences, and poorer outcomes. So the question isn’t just is PT covered? It’s how is MSK integrated into your insurance model and is that model working for you?

Healthcare costs keep rising but employers can reverse the trend

In 2024, the average annual cost of employer-sponsored health coverage reached $24,462 per family¹. Healthcare inflation is outpacing wage growth³, and employers are being forced to absorb more of the burden.

Key drivers of rising spend

- High-cost claims from chronic conditions like diabetes, heart disease, and musculoskeletal (MSK) pain

- Specialty drug costs and opaque pharmacy benefit structures

- Overuse of low-value care like unnecessary imaging or surgery

- Administrative waste and underuse of preventative services

With CFOs and finance teams scrutinizing benefits line items, benefits leaders need strategies that can contain costs without reducing access or quality. But without the right strategy, the pressure to contain costs can backfire.

Some employers may feel forced to limit benefits or shift more costs onto employees. This not only harms employee satisfaction and retention, but also creates long-term risk. When access to preventative care is reduced, especially in areas like MSK health, "low pain" issues are left to fester.

These minor conditions often progress into more acute, costly medical needs. When MSK issues escalate, they are more likely to result in imaging, injections, or even avoidable surgery. This means higher long-term claims, lost productivity, and preventable healthcare problems for large chunks of your member population. Instead of cutting, the smarter approach is to optimize:

- reduce low-value care

- support early intervention

- align with vendors who deliver measurable outcomes

Smart planning and the partnership of effective value-based care providers can help you reduce costs while you increase the quality of care and the healthcare outcomes for your people.

The good news is that employers are not powerless against rising costs. By rethinking how care is structured and delivered, leaders can build benefits that are both affordable and high-performing. The key lies in modern insurance design: aligning incentives, removing barriers, and holding vendors accountable for real outcomes.

7 ways to redesign your MSK strategy for maximum return

The following seven tactics highlight how forward-thinking employers are redesigning their MSK and overall healthcare models to reduce spend while improving member health and experience.

1. Rethink plan design to shift from volume to value

Most traditional health plans reward volume. Providers are paid per visit, not for outcomes. This fee-for-service structure encourages overutilization without accountability. Employers are shifting toward value-based insurance design (VBID), which aligns incentives with outcomes. Key tactics include:

- Centers of excellence for high-cost procedures like joint replacement or bariatric surgery

- Reference-based pricing for shoppable services

- Tiered networks to steer members to high-quality, lower-cost providers

These strategies reduce variation in quality and spend. A 2021 study found reference pricing for joint replacement reduced surgical costs by more than 20% without sacrificing outcomes⁴.

2. Carve out high-cost categories like pharmacy and MSK

Carve-outs allow employers to manage specific benefit areas outside their primary insurance carrier. This approach increases transparency and control, especially in high-spend categories like pharmacy and musculoskeletal care.

Pharmacy carve-outs

Traditional pharmacy benefit managers (PBMs) often operate with opaque pricing and hidden markups. Employers are increasingly exploring transparent PBMs or direct sourcing to lower costs.

Preventative MSK care can drive lasting savings

Musculoskeletal care is the number one cost driver in U.S. health plans². Yet most MSK spend is avoidable with early, conservative care. Employers that carve out MSK services and work with digital-first providers like Sword Health can reduce spend while improving member outcomes.

Sword's digital delivery model changes how care is delivered and experienced. By removing barriers like travel, wait times, and rigid clinic schedules, Sword makes it easier for people to start and stick with treatment. Members can complete therapy on their time, at home, which drives stronger engagement and adherence. In fact, Sword's adherence rates are more than double those of traditional PT settings³.

This added flexibility leads to fewer dropouts and earlier intervention. When "low pain" issues are addressed early, it prevents escalation into more serious and expensive procedures like MRIs, injections, or even avoidable surgeries². Sword's model keeps people out of the surgical funnel by helping them recover before high-cost interventions become necessary.

Sword’s care model has been clinically validated, with outcomes that rival and often surpass in-person physical therapy⁵. And with outcome-based pricing, employers only pay when members reach recovery goals². That means better health outcomes, greater member satisfaction, and proven ROI from a high-quality provider who is financially accountable for results.

3. Invest in digital-first, preventative care for chronic conditions

Early intervention changes the cost trajectory of chronic disease. But traditional care models delay treatment due to referral friction, scheduling barriers, or member confusion.

Digital-first care programs remove these barriers and make it easier to intervene early. This is especially effective in conditions like MSK pain, diabetes, hypertension, and anxiety.

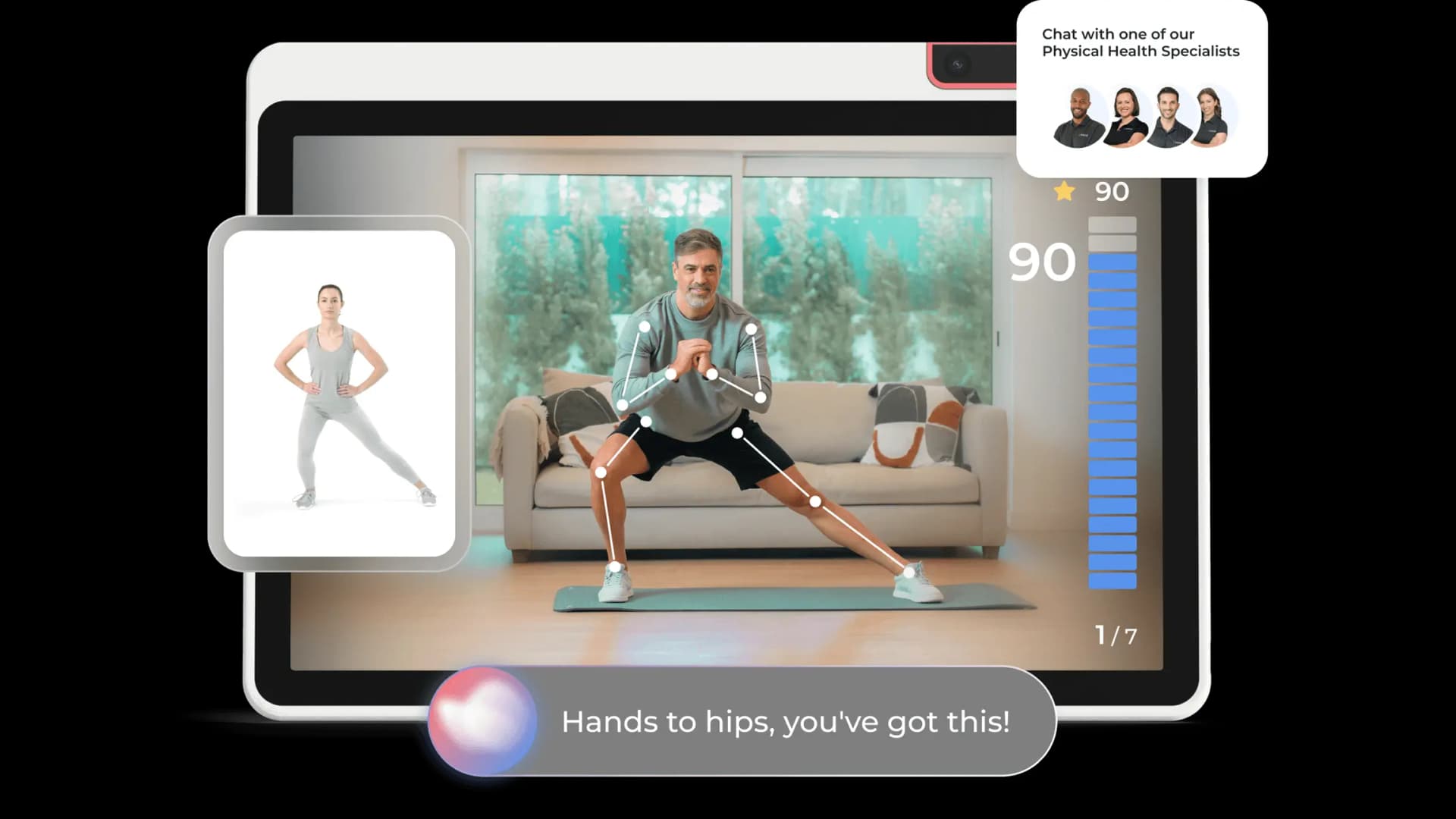

What is Sword?

Sword Health offers a clinically-guided digital physical therapy program that helps members recover from back pain, joint issues, injury, or surgery, all from home. Sword pairs each member with a licensed Doctor of Physical Therapy, who guides care through an app and wearable technology.

How it works

- Members receive an FDA-pproved medical device to guide their exercises

- Each member is matched with a Doctor of Physical Therapy who develops a personalized program to speed up progress

- AI-driven biofeedback gives real-time form correction

- The member’s PT reviews performance data to add accountability and adjusts treatment daily

Why it works

- Members start care within 6.3 days⁶ (compared to 17+ for in-person PT)

- 81% complete their care plans, compared to <40% in traditional settings⁵

- Sword saves employers $3,177 per member per year²

4. Improve employee engagement with smarter health navigation

The best benefits don’t matter if employees don’t use them. Underutilization is a major hidden cost driver.

To reduce waste, employers must help employees:

- Understand their coverage

- Access the right care at the right time

- Choose high-value providers

Digital navigation tools and concierge platforms make it easier for members to understand options and make smarter choices. Personalized guidance, plan data in apps, and behavioral nudges can increase the use of preventative and cost-effective services.

How Sword supports navigation

Sword’s digital onboarding, push notifications, and personalized progress tracking make it simple for members to stick with care. Clinical teams stay in touch with each member, encouraging adherence, celebrating wins, and updating plans in real time.

5. Direct contract with high-quality, low-cost providers

Direct contracting allows employers to bypass traditional carrier networks and work directly with health systems or vendors. This gives employers more control over pricing, quality standards, and reporting.

Direct contracts are especially effective for high-cost, episodic procedures like:

- Joint replacement

- Spine surgery

- Bariatric surgery

- Maternity care

Employers can bundle payments, require adherence to clinical pathways, and receive guaranteed outcome metrics. Sword’s digital MSK care can complement these models by keeping employees out of the surgical funnel in the first place².

6. Use predictive analytics to prevent high-cost events

Many of the costliest claims don’t come out of nowhere. They follow patterns, and with the right data, those patterns can be spotted in time to intervene.

Predictive analytics tools can:

- Flag members at high risk for surgery or emergency visits

- Identify low-engagement members in chronic care programs

- Predict downstream spend based on biometric or utilization trends

Example: Sword Predict

Sword Predict is an AI engine that identifies members at risk of surgery, imaging, or opioid use. It triggers outreach and intervention before costs escalate.

Results

- Delivers up to 4.4x ROI for high-risk members²

- Helps prevent unnecessary procedures by guiding members to conservative care early²

7. Measure ROI and outcomes to hold vendors accountable

Every vendor should be accountable for the outcomes they promise. Yet too often, employers pay for services regardless of whether members improve. Outcome-based pricing flips that model. Employers only pay when members see meaningful clinical improvement. Sword’s outcome-based pricing model ensures that employers only pay for results. It aligns clinical goals with financial impact:

- No inflated pricing

- Payments are capped $1,000 per member

- Members can enroll in multiple Sword programs with unlimited sessions

- Payment only triggered when members meaningfully improve on target goals like reducing pain, improving function, or increased productivity²

- Transparent reporting on outcomes, engagement, and savings

This gives finance teams confidence in spend, and HR teams a reliable way to prove value.

Why Sword Health fits all three MSK models

Sword’s relevance to insurance design is clear.

- For carve-outs, Sword provides transparent pricing, outcome guarantees, and reporting that makes ROI easy to validate.

- For direct contracts, Sword’s scalable digital model integrates smoothly into employer-provider agreements, offering predictable pricing and superior member experience.

- For bundles, Sword creates a complete episode of conservative care, reducing surgical intent by up to 70%⁷ and preventing unnecessary claims².

Employers who choose Sword gain both financial control and clinical quality. By offering MSK care that is convenient, effective, and outcome-driven, they can reduce costs without sacrificing benefits. Independent studies and Sword’s own ROI analysis confirm the results.

- Employers save an average of $3,177 per member per year², with up to 4.4x ROI in high-risk groups².

- 68% of members regain lost productivity, saving employers an additional $2,916 annually in productivity value².

- Clinical outcomes are equally strong: 64% reduction in depression, 50% reduction in anxiety⁶, and up to 70% reduction in surgical intent⁷.

What employers can expect when onboarding Sword

Partnering with Sword is straightforward. Employers begin with an implementation process that integrates Sword into their existing benefits structure, whether as a carve-out, direct contract, or bundled solution.

Members gain access within an average of 6.3 days⁶, and engagement begins immediately through digital onboarding and personalized outreach. Reporting is transparent from day one, with dashboards showing clinical outcomes, adherence, and cost savings. For benefits leaders and CFOs, this provides confidence that MSK spend is being managed responsibly.

Lower healthcare costs while you increase quality of care

Cost containment doesn’t have to mean cutting corners. With smart strategy and modern tools, employers can offer better benefits and still reduce spend. The key is shifting from reactive to proactive care. From volume to value. From in-person friction to digital-first convenience. MSK care is the perfect example: expensive when managed poorly, cost-effective when done right.

Sword Health delivers better healthcare outcomes with proven results and guaranteed return on investment. You can reshape your MSK model and start offering clinically-proven digital care with the confidence of payments tied to success.

Start saving $3,177 per member per year

Slash MSK costs and get the industry’s top validated ROI of 3.2:1.

Footnotes

Kaiser Family Foundation. (2023). Employer Health Benefits Survey. https://www.kff.org/report-section/ehbs-2023-summary-of-findings/

Sword Health. (2025). ROI Guide: Proven Savings with Digital MSK Care. https://swordhealth.com/roi

U.S. Bureau of Labor Statistics. (2024). Healthcare costs rising faster than wages. https://www.bls.gov/opub/ted/2024/health-care-costs-outpacing-wage-growth.htm

Science Direct. (2021). Reference Pricing for Joint Replacement Study. https://www.sciencedirect.com/science/article/abs/pii/S0883540320311128#:~:text=We%20analyzed%207148%20primary%20TKAs,cementless%20knees%20resulted%20from%20RP.

npj Digital Medicine. (2023). Clinical validation of Sword Health digital MSK care. https://www.nature.com/articles/s41746-023-00870-3

Journal of Pain Research. (2022). Impact of digital MSK care on mental health outcomes. https://www.dovepress.com/the-impact-of-digital-msk-care-on-mental-health-peer-reviewed-article-JPR

Healthcare Journal. (2022). Reducing surgery intent through digital MSK care. https://www.mdpi.com/2227-9032/10/8/1595